Understanding Loans and Small Business Funding Opportunities | Work it Wednesday Webinar

B. Fae Harris

B. Fae Harris graciously joined us to share how to establish an ideal business profile for successful lending.

B. Fae. Harris is the Cleveland market Multicultural Community Impact Team Member for National Development Council (NDC). At NDC, she specializes in bringing high-performance products to market. Over the past 15 years, she’s worked with global industry plays such as L’Oreal, Kao Brands, and Conair Professional Products. Her brand management experience spans from entrepreneurial to established global brands with multi-million dollar portfolios. Ms. Harris is a Boston native with a Bachelor of Science degree from Babson College. She also holds a dual Master’s degree in Business Administration and Information Age Marketing from Bentley University.

Some of the questions asked during the webinar were:

- What other assistance does the NDC provide to make sure a business owner is properly positioned to get lending?

- If you did not recieve funding round one, are you eligible to receive funding in round two for the Paycheck Protection Program Loan?

- In round one of the Paycheck Protection Program Loan, a lot of businesses said they were having difficulty getting funding because they have 1099 contractors. Has this issue been addressed for round 2 of the Paycheck Protection Program Loan?

- What is required for round two funding for the Paycheck Protection Program Loan for those who received funding in round one and exhausted their funds?

- If we applied for the first round of the Paycheck Protection Program Loan and recieve those funds but don’t show a decline, are we still eligible to apply for round two?

- Are grants counted as revenue?

- What are some of your other lending products?

- What is the cap on the loan?

- Are the terms favorable for the loan?

- If I were expanding to a new city, do I have to be located in that city to apply for the loan?

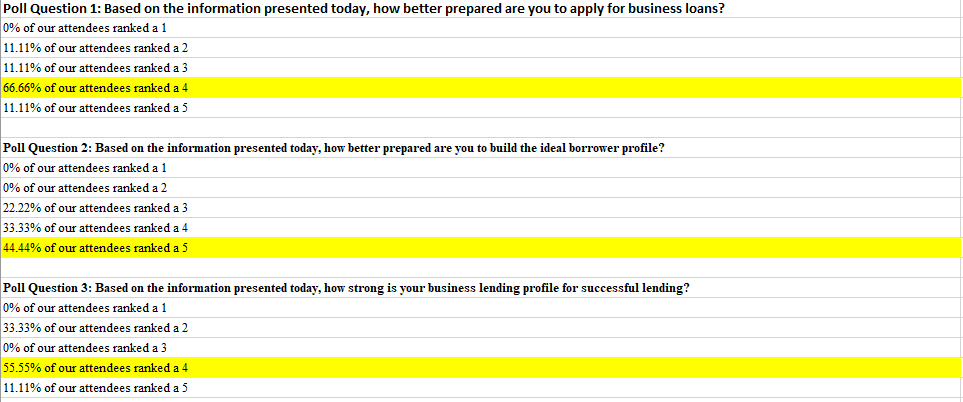

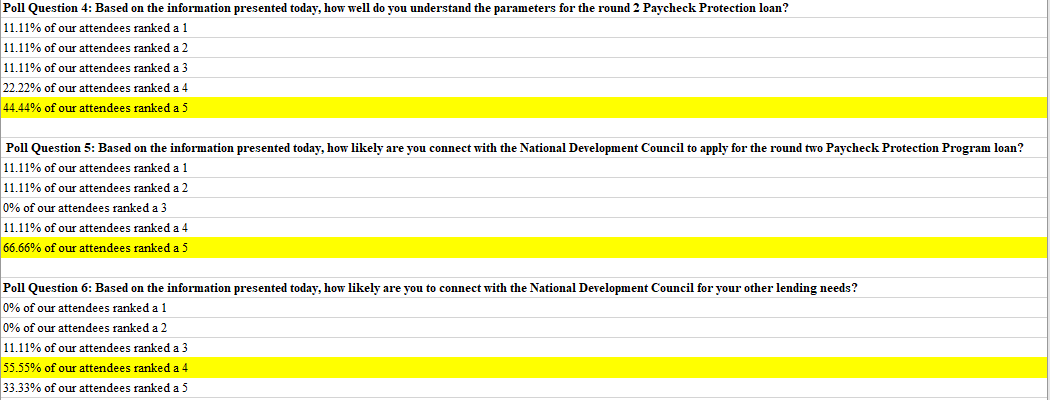

During the presentation, we asked attendees to rank how they felt based on the information presented to them during the webinar.

66.66% of attendees ranked a 5 for how better prepared they are to apply for a business loan based on the information presented at the webinar.

55.55% of attendees ranked a 4 for how likely they are to connect with NDC for their other lending needs based on the information presented during the webinar.

This Post Has 0 Comments